The 2023 data of the European photovoltaic BESS market

They are called BESS, an acronym for Battery Energy Storage Systems. They represent one of the fundamental elements that ensure flexibility in the network with the progressive penetration of photovoltaic and wind. Solarpower Europe is keeping an eye on its growth and on 12 June published a new 2023 trend report for solar battery storage. The document shows how last year in Europe the market of photovoltaic BESS installed 17.2 GWh of new storage capacity, reaching a total cumulative capacity of 35.9 GWh.

Segment analysis

Parallel to the trend that has investing solar, the growth of the BESS photovoltaic market has been driven mainly by the residential segment as a response to the expensive bill of these years. The European domestic segment “turned on” 12 GWh of stationary battery storage in 2023, accounting for 70% of the total added capacity. The promising (but still little exploited) segment of commercial and industrial batteries (C&I) has contributed instead with 1.6 GWh (9%) while batteries on a network scale with new 3.6 GWh (21%).

Drawing the sums at the end of last year, in the Old Continent, the fleet BESS operating total turned out concentrated: for 63% in the segment Residential, for 27% in that on Scala Utility and for 10% in the segment Commercial and Industrial (C&I).

Battery storage systems: past and future trends

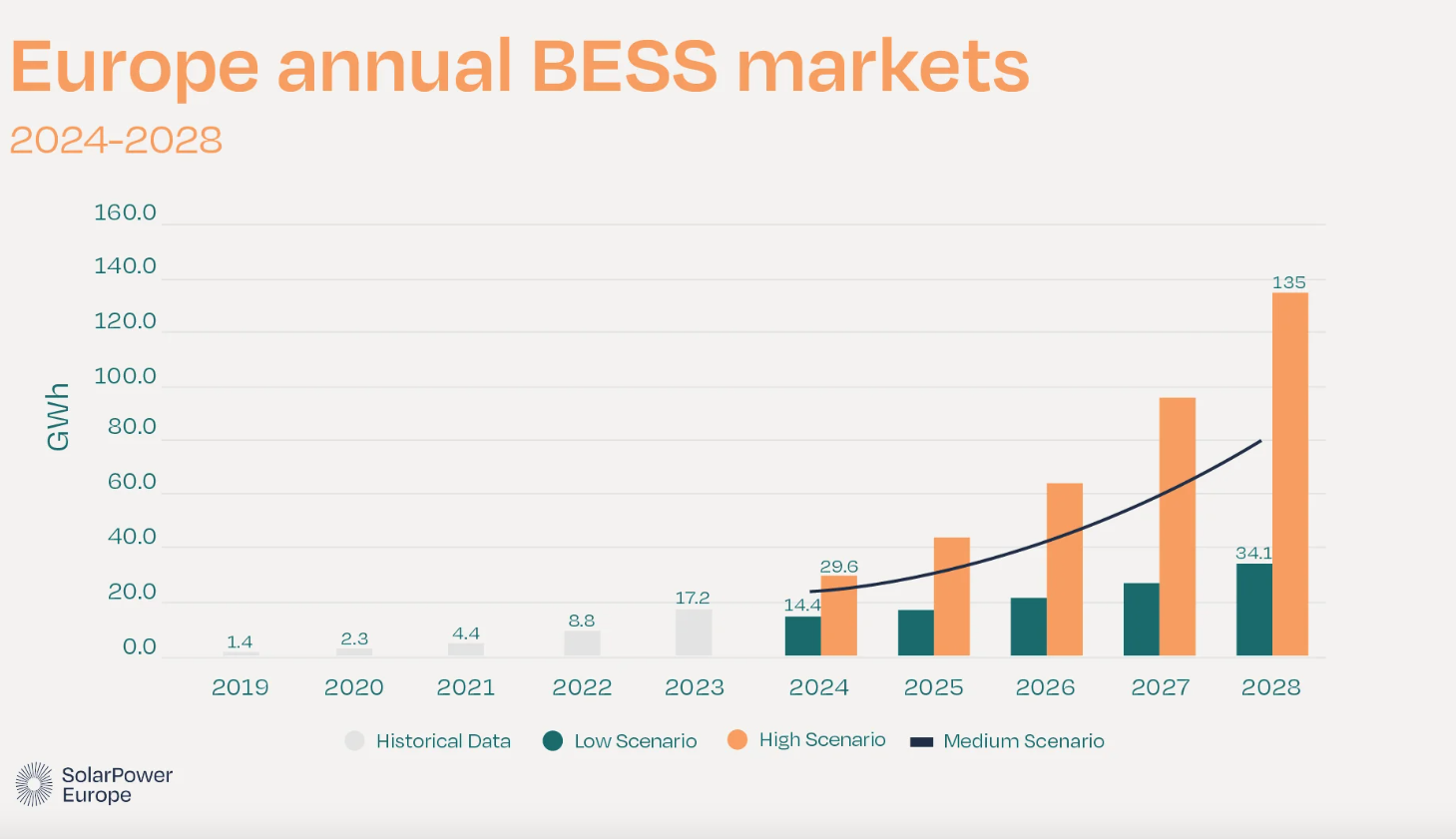

For the compartment those 17.2 GWh of additions 2023 represent an increase on an annual basis of 94%, almost double the value 2022. This is not an isolated episode, but the third year of exponential growth. A positive trend born in conjunction with the fossil energy crisis and that should not stop soon. At least with the right political and regulatory incentives. The association estimates that BESS markets will maintain their upward trajectory between 2025 and 2028, with sustained growth rates (albeit slower than in the last two years) between 30 and 40%. “The total installed BESS capacity in Europe is expected to increase by more than seven times to reach 260 GWh of battery storage by 2028,” writes SolarPower Europe.

Photovoltaic Batteries, the first 5 European Markets

Some European countries have contributed more than others to this “energy relay”. In detail, on the podium, we find Germany, Italy and the United Kingdom. The German photovoltaic battery storage market has maintained its leading position, putting into operation in 2023 a well 5.9 GWh, equal to an annual increase of 152%. The Bel Paese has followed it closely, marking its national record: 3.7 GWh of BESS photovoltaics installed (more 86% on 2022). The UK, on the other hand, stood out with 2.7 GWh of batteries in stationary storage (plus 91%). In the top-five complete the picture Austria with 1 GWh of battery storage systems added annually and the Czech Republic with 900 MWh.

BESS Photovoltaics, Italy is the 2nd largest European market

In terms of total cumulated capacity, Italy does not lose its position. Today with 6.5 GWh of photovoltaic batteries installed in total, it is the second largest European market for BESS. This is due to the residential segment, which alone provided 3.1 GWh, which is 84% of the capacity added in 2023. Obviously the strong performance of domestic battery storage systems is mainly due to the introduction of the Superbonus 110% in 2020.

However, when it comes to utility-scale BESS, there is no shortage of difficulties, as SolarPower Europe explains. “Despite being one of the most attractive markets in Europe – thanks to the opening of important revenue streams, capacity auctions, ambitious storage targets and the strong penetration of renewable energy that requires flexibility – the segment did not take off in 2023. Delays in projects have affected the implementation of large batteries, and the slippage of the year installation record in Italy to 2024 “.

The challenges to be solved

“Over the past decade, the decrease in investment costs for battery storage, driven by technological advances, economies of scale and lower raw material prices, has improved […] the cost competitiveness of solar PV combined with BESS“, commented Antonio Arruebo, market analyst at SolarPower Europe. “This combination is already an optimal solution to address our energy trilemma of safety, sustainability and affordability“. However, now that the effects of the energy crisis have diminished, the convenience of investing in self-sufficiency may appear less obvious.