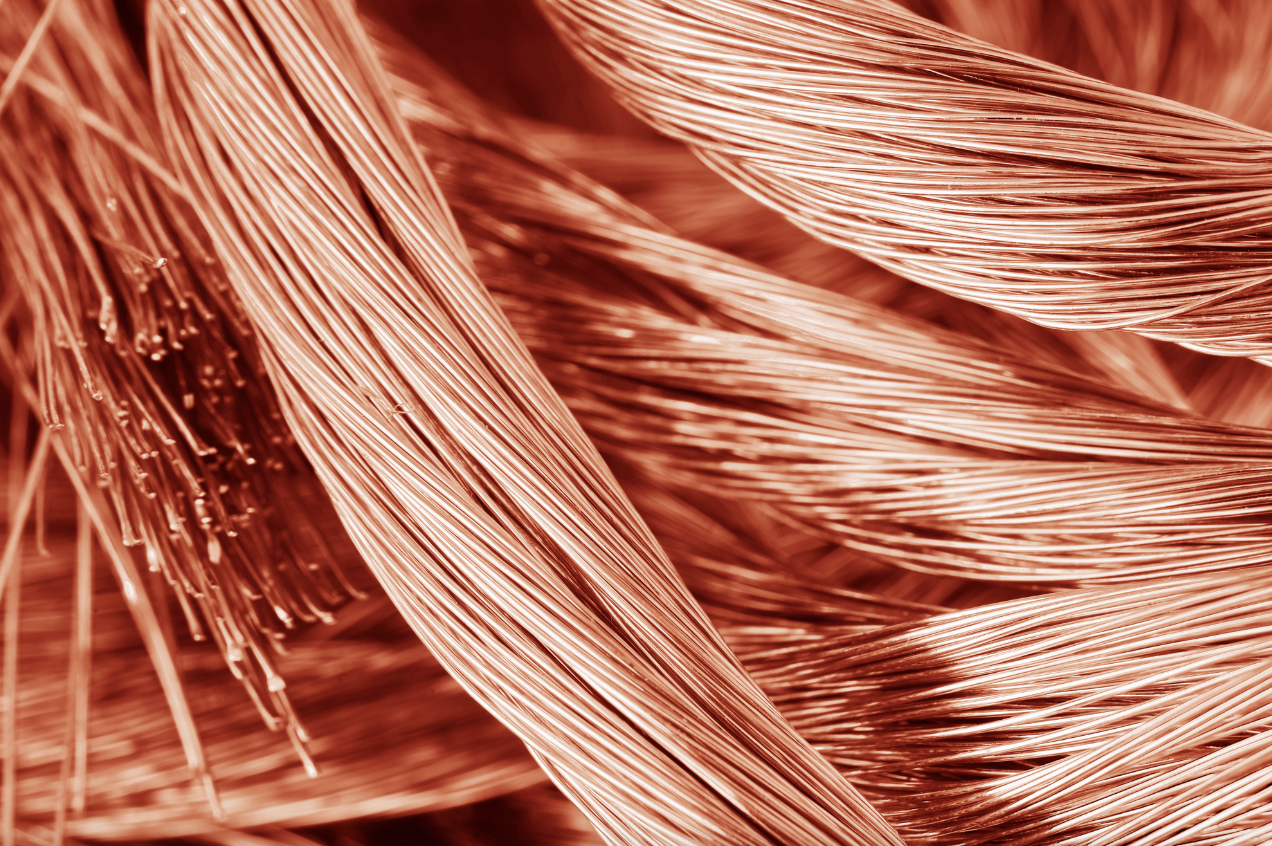

Between now and 2035, the announced or already mobilized investments for two of the key minerals for the technologies at the heart of the transition will only meet 50-70% of expected demand growth. And the geography of the resources invested, in the medium term, will not affect China’s dominant position

The IEA report gives for the 1st time an overall risk assessment for critical minerals

Investment in transition critical minerals is not yet sufficient. By 2035, resources announced or already deployed can cover only 70% of global copper demand growth and half that of lithium, assuming that all national plans are met to the letter. And again, the geography of current investments would not change one of the most problematic points: the extreme concentration of the chain of critical raw minerals in the hands of China, especially for the refining segment.

This is the warning issued today by the International Energy Agency in the Global Critical Minerals Outlook 2024 report. “Safe and sustainable access to critical minerals is essential for smooth and affordable transitions to clean energy. The world’s appetite for technologies such as solar panels, electric cars and batteries is growing rapidly, but we cannot satisfy it without reliable and expanding supplies of critical minerals,” said IEA Executive Director Fatih Birol.

Critical minerals, falling prices and reduced supply-demand gap

The report brings comforting news. Compared to recent years, the prices of minerals critical for the transition have finally begun to fall. Returning to pre-pandemic levels. Also thanks to the increased supply. The minerals used to produce the batteries recorded particularly significant decreases: the price of lithium fell by 75%, those of cobalt, nickel and graphite by between 30% and 45%. Overall, the downward trajectory helped lower battery costs by 14%.

All in all, good news also on the investment front: they grew by 10% in 2023, with resources oriented towards new explorations increasing by 15%. However, the pace is slightly slowing compared to the previous year. And in the medium term it is not sufficient to cover the expected increase in demand in any of the IEA’s transition scenarios.

The report on critical minerals also provides, for the first time, an overall assessment of the level of risk for each mineral. Lithium and copper are the most vulnerable to supply and volume risks, while graphite, cobalt, rare earths and nickel present the most substantial geopolitical risks. For graphite, in particular, the current pipeline of projects suggests that the supply available beyond China “meets only 10% of demand in 2030, making the announced diversification targets very difficult to achieve“. Finally, most minerals are exposed to high environmental risks.