Prices for photovoltaic modules in 2024 continue to fall. According to the monthly index published by Germany’s pvXchange Trading, the downward trend persists, driven largely—if not entirely—by Asian overproduction.

The index focuses on the European market, which pvXchange has been monitoring since 2009 with a unique pricing tool. This tool highlights trends in the sector by categorizing products into three main types:

- High-Efficiency Crystalline Silicon Modules

This category includes panels with heterojunction (HJT) mono or bifacial cells, type-N TOPCon, BC (Back Contact), or combinations thereof, provided their efficiency exceeds 22%. - Mainstream Crystalline Silicon Modules

Standard panels featuring monocrystalline PERC or TOPCon cells used mainly in commercial systems, with efficiencies up to 22%, fall under this category. - Low-Cost Crystalline Silicon Modules

The “low-cost” segment encompasses leftover stocks, lower-performance modules, B-grade stock, insolvent goods, used photovoltaic panels, and products with limited or no warranty, which typically lack bankability.

The latest data reveal a continued price drop, reflecting the oversupply’s impact on market dynamics.

A Reintroduction in 2025: Full Black Solar Panels

In 2025, pvXchange Trading reintroduced a fourth product category that had previously been removed due to its overlap with the “High Efficiency” category: Full Black solar modules. These sleek, fully black panels—characterized by a completely black frame and cells—include advanced technologies such as mono- or bifacial HJT, type-N TOPCon, BC, and their combinations, with efficiencies reaching up to 22.5%.

How Much Do Solar Photovoltaic Modules Cost in 2025?

As of January 2025, solar module prices have remained relatively stable across all categories, including ultra-high-efficiency products and other module classes. While there have been minor price increases in the two lower categories—partially due to the updated classification—the overall market has yet to see significant price changes.

However, analysts are raising concerns over certain trends in the solar market. Supply shortages for specific high-power modules, which have historically been limited and often sold exclusively to select clients, are becoming more pronounced. This challenge also extends to modules designed for large-scale installations, where availability is increasingly tight.

Another pressing issue for the industry is the difficulty in sourcing some inverters and energy storage systems. Many suppliers are now steering customers toward alternative products to address these shortages. According to industry experts, the delays are attributed to post-holiday shipping bottlenecks and potential intentional production slowdowns.

But let’s take a closer look at the figures recorded in January 2025:

| Module Category | €/Wp | Trend Since December 2024 | Trend Since January 2024 | Description |

|---|---|---|---|---|

| High Efficiency | €0.13 | Stable | -45.70% | Photovoltaic modules with monocrystalline or bifacial HJT cells, N-type/TOPCon or xBC (Back Contact) and their combinations, with efficiencies above 22.5%. |

| Full Black | €0.13 | Stable | -40.90% | Photovoltaic modules with monocrystalline or bifacial HJT cells, N-type/TOPCon or xBC (Back Contact) and their combinations, with efficiencies up to 22.5%. |

| Mainstream | €0.11 | +10.5% | -25.00% | Photovoltaic modules with monocrystalline or bifacial HJT cells, N-type/TOPCon or xBC (Back Contact) and their combinations, with efficiencies up to 22.5%. |

| Low Cost | €0.07 | +8.3% | -27.80% | Warehouse stock, factory seconds, defective products, used modules, or low-power modules with limited or no warranty, which in some cases may not be bankable. |

Only the prices of tax-free photovoltaic modules are shown.

The values given reflect average prices offered at retail and on the European spot market.

December 2024 Solar Panel Price Update

As we analyze the latest available data—December 2024—the solar panel market has seen a continued price decline, though trends indicate that the downward curve is starting to flatten. Here’s a detailed breakdown:

- High-Efficiency Solar Panels: The average price was €0.125/Wp, marking a 3.8% decrease compared to October 2024.

- Mainstream Solar Panels: Prices averaged €0.095/Wp, experiencing a 5% decline from October 2024.

- Low-Cost Solar Panels: Prices remained stable at €0.060/Wp, unchanged from the previous month.

Despite limited room for further price reductions across all solar module categories, manufacturers and distributors still hold large inventories that must be cleared before the year-end to balance their books.

As Engineer Martin Schachinger wrote just before Christmas, “The industry’s goal was to start 2025 with the emptiest warehouses possible.” This led to an influx of exceptionally low-price offers throughout December, often disconnected from the real value of the products.

Will Solar Panel Prices Increase in 2025?

All indicators point to a rise in photovoltaic module prices in the first quarter of 2025. However, the extent of this increase remains uncertain.

“How high prices will go,” writes industry expert Martin Schachinger, “depends on whether the artificial export restrictions allegedly coordinated by Chinese manufacturers are broadly enforced and on the level of demand in the European market over the coming months.”

If demand drops significantly, the expected shortage may not materialize, keeping prices low. However, if supply constraints are fully implemented and demand remains stable or rises, we could see a notable price surge in the first part of 2025.

Photovoltaic Module Prices: November 2024

In November 2024, the price of solar panels saw another significant drop, continuing the annual trend. However, analysts at pvXchange Trading believe this trend might not persist much longer. According to engineer Martin Schachinger, “The sharp price drop in November could be the last of its kind for now. The pain threshold appears to have been reached, or even surpassed, and all indications point to a recovery.”

What remains undeniable is that prices fell significantly from October to November, with an average month-on-month decline of 8%. Schachinger notes, “An average price drop of around 8% across all technology classes effectively erases any margin that could still be achieved, even with recently purchased modules.”

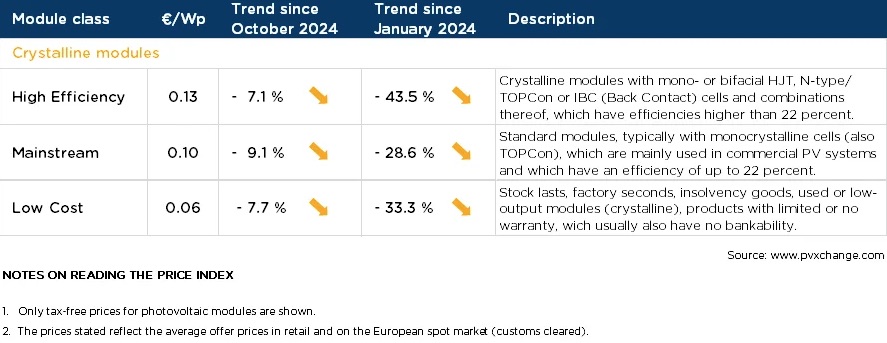

Current Solar Panel Prices

Breaking down the specifics:

- High-Efficiency Photovoltaic Modules: Average price of €0.13/Wp, down 7.1% compared to October 2024.

- Mainstream Photovoltaic Panels: Average price of €0.10/Wp, down 9.1% month-on-month.

- Low-Cost Photovoltaic Modules: Average price of €0.060/Wp, a decrease of 7.7% compared to the previous month.

These figures underscore the significant pressures in the photovoltaic market, as price reductions strain margins to unprecedented levels.

Photovoltaic Module Prices: Stabilization in Sight Amid Turbulent 2024

According to Martin Schachinger, the downward spiral in photovoltaic module prices may finally be nearing its end. “Currently, there are several indications that prices are stabilizing and even beginning to rise again. One reason could be the end of high tax rebates on exported solar modules. Many readers may not realize that China taxes the export of certain goods, such as raw materials and energy products. For solar modules, the standard tax rate is 13%, but it was discounted to 0 for a long time. Starting December 1, the tax rebate for newly exported modules will be reduced to 9%, increasing exporters’ costs by 4%.”

Impact on Pricing

What does this mean? “Considering the current low base prices,” Schachinger explains, “this doesn’t have severe consequences. Nonetheless, this measure alone is expected to result in a price increase of 0.3 to 0.5 cents per watt-peak.”

October 2024 Price Trends

An analysis by pvXchange reveals significant monthly and yearly price reductions across almost all categories in October 2024:

- High-Efficiency Modules: Average price of €0.14/Wp, down 6.7% from September 2024 and 39.1% from January 2024.

- Mainstream Modules: Average price of €0.11/Wp, stable compared to September but 21.4% lower than January 2024.

- Low-Cost Modules: Average price of €0.065/Wp, a 7.1% decrease from September and 27.8% from January 2024.

Challenges Facing the Industry

These trends are exerting mounting pressure on the photovoltaic sector. “Things are not going well for the PV industry right now,” Schachinger notes. “Corporate bankruptcies are on the rise, reflecting a broader trend visible across all industries in Germany. According to Deutsche Wirtschaftsnachrichten, the number of insolvencies in Q3 2024 reached a grim level not seen since 2010.”

Inventory Devaluation

One significant challenge is the depreciation of stock, particularly for high-performance modules. “Contrary to all expectations, the average price of high-efficiency modules dropped another 1 cent per watt-peak, while other module categories saw minimal change. It seems that many suppliers are still so desperate to sell that they continue to devalue their panel inventory, including the most sought-after types, just to boost sales,” explains Schachinger.

However, the expert warns that this strategy may not be sustainable. “The last six to nine months show that this approach doesn’t always work. Even as components and turnkey systems become cheaper, demand—and consequently sales volumes—doesn’t necessarily increase.”

The industry’s resilience will be tested as it navigates these turbulent dynamics and the potential for a price rebound in the months ahead.

Article from December 12, 2024, updated on January 28, 2025