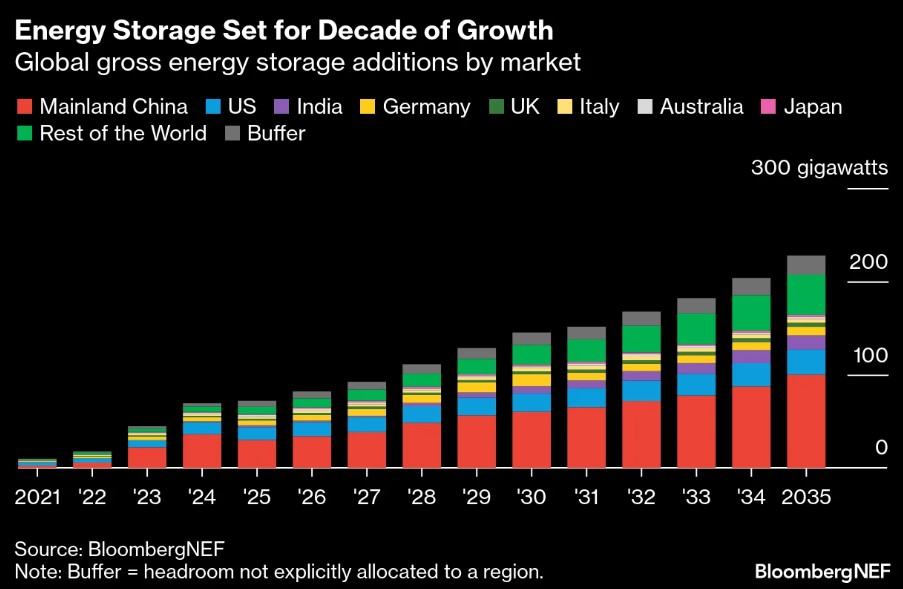

The global energy storage sector is expected to experience significant growth in the coming years, but the two largest markets for storage – China and the United States – could minimize their commitment

Global energy storage is set to reach another historic record. In 2024, the new capacity added will significantly exceed the previous year’s results. BloombergNEF predicts a 76% annual increase in global installations, equivalent to more than 69 GW of power and 169 GWh of capacity.

This positive trend, according to BNEF’s forecasts, is expected to continue in the near future, although there are significant challenges ahead. The two main energy storage markets, China and the United States, may sharply slow down the growth that has placed them at the top in recent years.

Energy Storage: The Slowdown of the US and China

Why is this happening? For Beijing, it would simply be a moment to catch its breath after a long period of acceleration. In recent years, China has worked hard to expand its storage capacity, setting several records, such as the first sodium-ion BESS and the most powerful flow battery ever installed. In fact, the real push for storage came in 2022, thanks to China’s 14th Five-Year Plan. The Chinese State Council included the goal of activating 30 GW of non-hydroelectric energy storage by 2025 in the plan.

The current push seems focused on provincial co-location mandates, which require adding batteries to new solar or wind sites. However, next year, annual growth in the Chinese market could drop by 17% in terms of new power added. BNEF estimates up to 30 GW/79 GWh of new storage capacity in China by 2025.

For the United States, the reason for the slowdown is fairly obvious. It is highly likely that the new Trump administration will usher in a new phase of energy development in the US, less focused on green and renewable energy, with significant impacts on new energy storage. On the other hand, the Inflation Reduction Act and certain state-level policies should continue to provide strong support for the sector, preventing stagnation at least until 2035.

Global Energy Storage, How Incentives Are Changing

In addition to the efforts (and setbacks) of the two major powers, global energy storage growth is now driven by auctions and tenders in Europe, Africa, and Latin America. The countries to watch, according to BNEF, include Spain, Poland, Greece, South Africa, Chile, and Brazil.

“Almost all major markets worldwide have energy storage targets, some of which are expanding as 2030 approaches,” write analysts Nelson Nsitem, Yayoi Sekine, and Andy Leach. “In line with these targets, governments have approved billions of dollars for support programs that are helping attract investments in energy storage capacity.” However, “the level of support required is decreasing, due to the combination of falling battery prices and the increasing volatility of energy prices in markets with higher renewable energy penetration.”

It’s not just the “how much” that is changing, but also the “how.” In Europe, as well as in Australia, for example, incentives have shifted from feed-in premiums or capital support to mechanisms such as two-way contracts for difference and long-term power purchase agreements. “This allows governments and electricity market operators to ensure that they are only helping developers manage their downside risk and preventing funding from going to projects that would otherwise be profitable.”

Italy’s Role in Energy Storage with the MACSE

Among the closely monitored markets, BNEF also highlights Italy, and for good reason. In October 2024, Italy’s Minister for the Environment formally approved the new operating rules for the Electricity Storage Capacity Procurement Mechanism (MACSE). This is the new forward market by Terna, which is expected to help Italy achieve its goal of 71 GWh/9 GW of new utility-scale storage, considered crucial for the security of the power system.

The mechanism will remain in effect until December 31, 2033, and will use competitive auctions to assign tailored quotas to authorized projects. The winners will receive annual payments to cover the investment and operational costs of the new storage plants they build.

Allocated resources for the operation: a total of 17.7 billion euros. Terna’s first auctions will focus on lithium-ion batteries and pumped hydro storage.

Storage Technologies, LFP Batteries Dominate the Market

From a strictly technological standpoint, BNEF predicts that lithium iron phosphate (LFP) will remain the dominant chemistry for global energy storage until 2035. Why? LFP batteries cost less than alternatives and offer a longer cycle life.

“The growth of LFP’s market share is made possible by the aggressive expansion of production capacity by Chinese battery manufacturers. Some battery producers outside China, many of whom have historically specialized in nickel-based lithium-ion batteries, are also increasing production of energy storage products using LFP. Key examples include South Korea’s LG Energy Solution and Samsung SDI, Japan’s Panasonic, and Norway’s Freyr.”