The European Commission has announced that it will impose new tariffs on Chinese imports of HVO and FAME, ranging from 12.8% to 36.4%

In 4 weeks, anti-dumping duties on Chinese biodiesel What is happening to European biofuel producers?

Between the suspension of projects and the closure of plants, the situation does not appear to be optimal, and today, some point their finger at biofuel imports from China as the cause of difficulties in the internal market. The European Commission, which announced the arrival of anti-dumping duties on Chinese biodiesel today, appears to have shifted this view. The new tariffs will be imposed provisionally in four weeks on imports of HVO (hydrotreated vegetable oil) and FAME (methyl esters of fatty acids), in percentages variable between 12.8% and 36.4%.

But how did we get to this point? And can European customs measures safeguard the EU industry? The answer is complex.

Palm oil: from Indonesia to the EU through China

It is undoubtedly true that, over the past two years, the European biofuel market has been flooded by imports of biofuels produced in China, mainly from used cooking oil. The first issue concerned the certifications accompanying these products, mainly classified as “advanced” and “waste-based”, as Community legislation requires. The investigation launched by the EU executive first revealed that the Chinese market served as a tool to evade Indonesian biodiesel tariffs. In other words, the biofuel produced in Indonesia from palm oil – a raw material banned in the EU – was brought to China and then re-labelled as advanced biofuels to be exported to the European Union.

Dumping practices in the biodiesel market

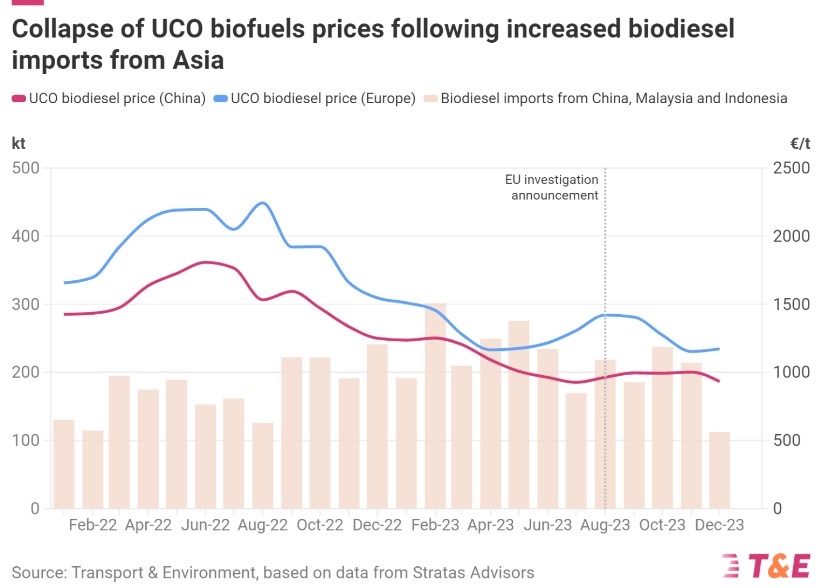

However, this is not the end of the matter since fraudulent biodiesel is only part of biofuel exports. As was the case with other products of the transition, such as solar panels, electric cars, or wind turbines, the biofuel made in China has quickly proved much cheaper than production in the block. And in 2023 the People’s Republic officially became the largest exporter of biodiesel to the Union, causing a market price collapse from around €2,250 per tonne to €1,100. On the other hand, a recent study by T&E has shown that collecting used oil in China is up to 30% cheaper than in Europe. But the suspicion that there was a forced sub-cost underlying this convenience quickly went away.

Meanwhile, the Community market has blamed the blow. “Chevron Renewable Energy Group forced German workers off, Shell suspended the construction of a biodiesel plant in the Netherlands, BP is suspending a biofuel project in Germany and Argent Energy even closed a biorefinery,” commented the European Biodiesel Board a few days ago. (EBB). “Al Chinese imports are not the only reason for these decisions, biodiesel dumping has contributed to the difficulties producers face.”

That is why the EBB itself launched a second investigation pointing to unfair commercial practices. And the first countermeasures have finally arrived. “Today we have achieved measures that will begin to rebalance the balance,” said EBB president Dickon Posnett. “Our next step is to work with the EU to close the loopholes that would otherwise jeopardise this good work and also work with Member States and the Commission to ensure that any fraudulent practice is addressed in the future by a more robust sustainability certification system.”

However, the association expressed severe concern about the unexpected exclusion of Chinese sustainable aviation fuel (SAF) from this intervention.

There is also concern on the part of the T&E association. Cian Delaney, a biofuel activist at T&E, explains: “Europe relies excessively on used cooking oil from distant countries such as China, which is difficult to verify. Restrictions on imports from China are a step in the right direction, however, anti-dumping tariffs alone will not be enough to combat UCO fraud. Without a complete review of the certification process, the EU will continue to play the game of the mole, as fraudsters from other countries will simply fill the gap. Brussels must stop encouraging imported used oils that are not verifiable and move from an industry-led verification system to stricter regulation.”