Lithium Battery Prices in December 2024

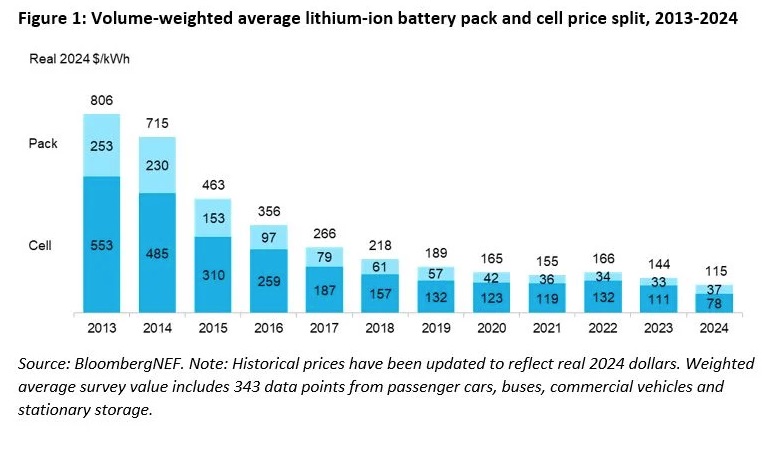

In 2024, the prices of lithium-ion battery cells have experienced a sharp decline, reaching $78 per kWh as a global average, which is $33 less than the average price in 2023. This represents a rare 20% drop. Battery packs have also decreased, with an average price of $115 per kWh, down from $144 per kWh in the previous year.

BloombergNEF (BNEF) provided the latest sector data, analyzing trends and causes. The figures represent the global average for the primary applications of lithium-ion batteries, including electric vehicles, electric buses, and stationary storage projects, excluding consumer electronics.

Why Are Lithium Battery Prices Falling?

The decline in prices is attributed to several factors, including excess battery cell production capacity, economies of scale, low metal and component prices, and the adoption of low-cost lithium iron phosphate (LFP) batteries.

In the past two years, the battery industry aggressively expanded production capacity in anticipation of growing demand from the electric vehicle and stationary storage sectors. However, the industry is now facing a widespread overcapacity, with 3.1 terawatt-hours of production capacity for battery cells globally. This represents more than 2.5 times the lithium-ion rechargeable battery demand for 2024.

Battery Pack and Cell Prices in 2024: Regional Market Response

While demand has also grown, it has not kept pace with supply. All the sectors analyzed by BNEF showed an upward trend. The electric vehicle market, the primary driver for lithium-ion batteries, grew more slowly than in previous years but still showed the lowest price at $97 per kWh.

Meanwhile, the stationary storage market has surged, with intense competition among cell and system suppliers, particularly in China.

Regionally, the average prices of lithium battery packs were lower in China, at $94 per kWh, while prices in the U.S. and Europe were 31% and 48% higher, respectively. This reflects the relative immaturity of these markets, along with higher production costs and lower volumes.

Lithium Battery Prices in September 2024

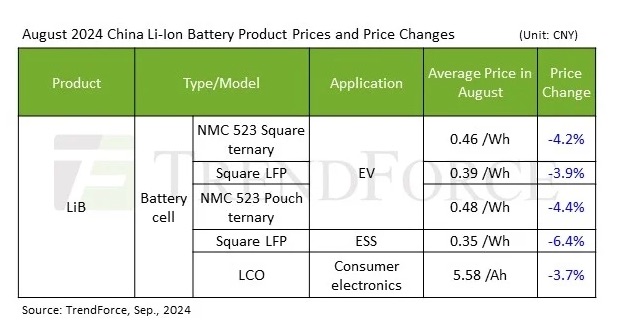

Battery prices continued to decrease, including those for electric vehicles, stationary storage, and consumer electronics. Data from TrendForce, a consultancy based in Taipei, revealed that in August 2024, the price reductions in raw materials, which had been declining in previous months, directly impacted the cell market. Monthly price drops ranged from 4% to 6%.

Electric vehicle battery cells dropped about 4%, reaching 0.39 CNY/Wh ($0.055/Wh) for LFP (lithium iron phosphate) cells. NMC (nickel-manganese-cobalt) cells for ternary and pouch batteries had an average price of 0.46 CNY/Wh ($0.065/Wh) and 0.48 CNY/Wh ($0.068/Wh), respectively. The most significant drop was in LFP cells for stationary storage systems, which saw a 6.4% monthly decrease, reaching a price of 0.35 CNY/Wh ($0.049/Wh).

Raw Material Market Impact

The drop in prices is linked to the weak market for battery metals such as nickel, cobalt, and lithium, particularly lithium spodumene, which saw a sharp drop, falling 16% quarter-over-quarter. Lithium carbonate, extracted from spodumene and other sources and used for making lithium metal for cathodes, also continued its downward trend, reaching a new historic low of 80,000 CNY/ton in August.

“Lithium carbonate prices have started to stabilize after hitting a low point in late August. Despite continued oversupply pressure on the Chinese market, the effects of upstream production cuts are gradually becoming evident,” explained TrendForce. “After a period of inventory reductions along the supply chain, demand is expected to improve with the arrival of the peak season (September-October), stimulating higher downstream storage activity. This could lead to a modest short-term rebound in lithium salt prices. However, long-term, the oversupply of lithium is unlikely to reverse, and the long-term trend for lithium carbonate prices will remain downward.”

Future Trends

According to TrendForce, cathode and cell producers are revising their production plans upward as downstream demand shows signs of recovery. In particular, the demand for battery cells for grid-scale storage systems continued to improve in August, driving sustained growth in orders for 314 Ah cells. The trend towards higher capacity cells remains unchanged, and prices continue to fall.