Rystad Energy's forecasts rely on strong growth in the global offshore wind sector, supported by increased investments and allocation auctions. But the bottlenecks in the supply chain continue to be a concern for the future of the market.

Offshore wind 2024: new capacity additions growing by 9% worldwide

The latest report from GWEC, the global wind energy association, has celebrated 2023 as another year of growth for the offshore wind sector worldwide. In 12 months, the sector has operated over 10 GW of new offshore wind turbines, bringing the total cumulative capacity for 2023 – including onshore installations – to 117 GW. This is a good result considering the undeniable difficulties of the period, both economically and in terms of the supply chain. But it falls short of expectations when compared to short- and long-term climate goals. To be truly useful for global decarbonization, the segment should, in fact, triple its growth rate and do so in a very short time.

Offshore wind sector 2024, short-term forecasts

The question that arises spontaneously is: will this be the year of the comeback? According to analysts, it seems not. One of the most “optimistic” forecasts was published recently by the energy research and intelligence company Rystad Energy. The document forecasts a 9% growth for the offshore wind sector worldwide in 2024, excluding China from the calculation. In other words, excluding the Chinese additions, this year the rest of the world is expected to install 11 GW of new offshore power.

The figure appears to be higher than the forecasts provided by GWEC in recent months, according to which offshore wind in 2024 would aim for only an additional 7 GW. A number would also include the new additions from the People’s Republic, which has become a global leader in this sector in recent years. With 6.3 GW commissioned in 2023, accounting for 58% of global additions, China now has 38 GW of offshore wind farms. 11% more than Europe. The expectations for his contribution in 2024 are inevitably high.

Offshore wind sector 2040, a look to the future

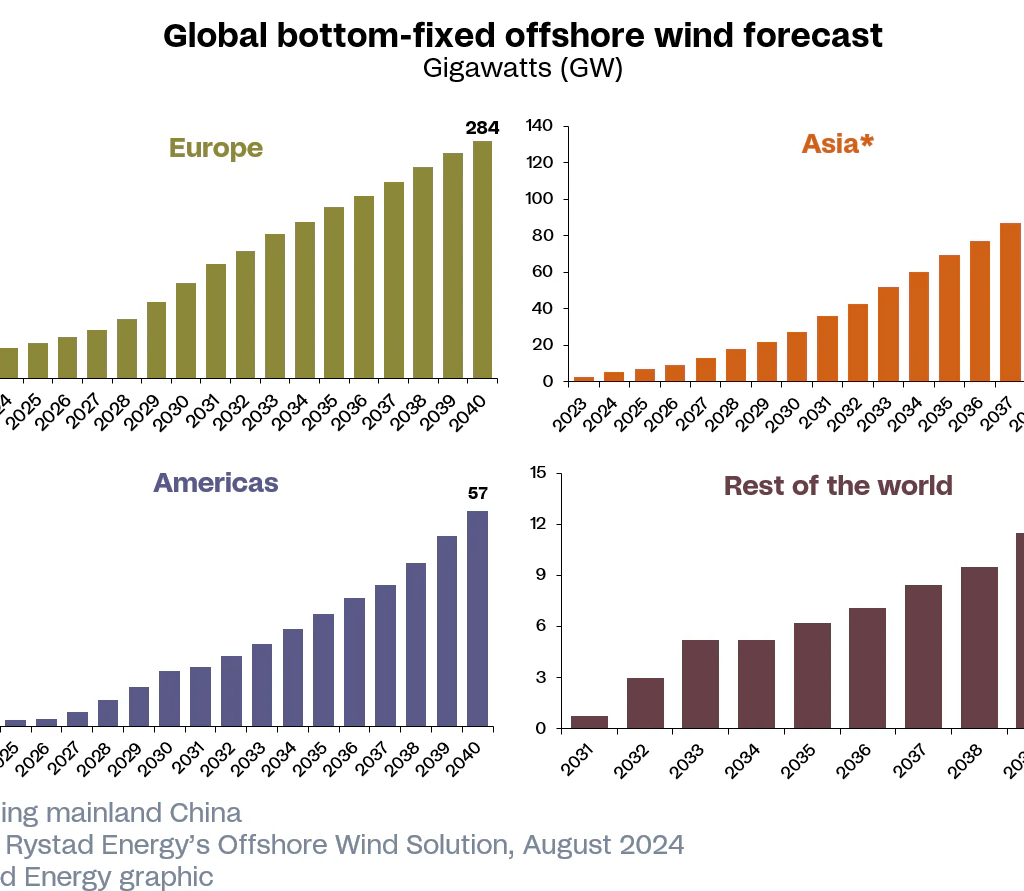

Rystad Energy predicts the current growth trend will continue steadily in the coming years. Estimating offshore wind installations worldwide (excluding China) will exceed 520 GW by 2040. In this landscape, the Old Continent will still have a crucial role, also thanks to the new goals for floating wind energy. By that date, Europe is expected to account for over 70% of the 90 GW of estimated operational “floating” wind installations worldwide. The United Kingdom, France, and Portugal are at the forefront of development.

In the fixed-foundation wind turbine segment (the so-called “bottom-fixed”), the company expects the United Kingdom, Germany, and the Netherlands to emerge as the three dominant players.

“The proximity of the countries to the North Sea and the vast maritime areas provides a solid foundation for success in offshore wind energy, reinforced by their installation and net-zero targets.” “It is estimated that these three countries together will represent 150 GW of installed capacity by 2040, followed by the United States with less than 40 GW,” writes Rystad Energy. “The future of the U.S. market is dependent on its political landscape, with concerns that if the presumed Republican presidential candidate Donald Trump were to win, his administration could significantly hinder offshore wind energy development.“

If China is removed from the equation, then Europe will dominate the sector. Both today and in the long term. The energy company forecasts 41 GW of installed offshore wind capacity for the continent by 2025 and over 112 GW by 2030, driven by the momentum of new competitive auctions. To learn more about sector developments, also read Offshore Wind Energy: 3 Possible Scenarios for the Future.

The obstacles to the growth of offshore wind energy

However, as analyst Petra Manuel points out, several bottlenecks still pose a challenge for today’s global offshore wind sector. It is no mystery that inflationary pressures and disruptions in the supply chain profoundly impacted the sector last year. Today, challenges weigh heavily on long and complex authorization processes. Not to mention that the growing wealth gaps between the North and South of the world have been exacerbated by the rise in inflation and the cost of capital. To the point that in many parts of the world, the growth of wind energy (both offshore and onshore) has been slow or completely nonexistent.

And as the GWEC has pointed out, the current technological era also brings challenges. Starting from the “rapid cycle of innovation in wind technology that undermines business profitability and jeopardizes product quality; interest groups that actively use technology and social media to spread misinformation about climate change and renewable energy, robotics, artificial intelligence, and automation, introducing further disruptions in workforce planning and labor; and a digitalization gap between countries that affects their ability to allocate land, authorize projects, and manage smart and modern grids.”

“The global offshore wind sector – emphasizes Petra Manuel from Rysta Energy – is experiencing robust growth, driven by increased investments and auction activities.” However, the bottlenecks in the supply chain present significant challenges to the further expansion of the sector. While ambitious goals boost investor confidence, it is essential to address logistical issues to ensure that offshore wind can successfully play a key role in the energy transition. “This will not only help the technology mature, but it will also promote a supportive ecosystem that inspires investor confidence.”