EHPA data show for 2023 a 6.5% decline in European heat pump sales, first decline after ten years of progressive annual growth

In 203 sold 3 million heat pump

Sales of heat pumps in Europe are falling. After the exploit recorded in conjunction with the energy crisis 2022, the trend of 2023 has slowed sharply, highlighting a decline of 6.5%. This is the first drop in ten years of uninterrupted and progressive growth, and those are already ready to raise the alarm. According to the European Heat Pump Association, in fact, this trade contraction risks – if prolonged – to jeopardize the EU’s 2030 climate targets. The same objectives have been highlighted by the European Union for the role of this technology.

Heat pump: 2030 targets and RED III

The Renewable Energy Directive of 2023 (better known as RED III) includes a chapter dedicated to heat pumps, which are considered essential “for the production of heating and cooling from renewable sources.”

“Through the rapid spread of heat pumps that exploit under-used types of renewable sources, such as environmental energy or geothermal energy, as well as waste heat from the industrial and tertiary sectors, including data centers, it is possible to replace natural gas and other fossil-fuel-powered boilers with a renewables heating solution, while increasing energy efficiency. This will speed up the reduction of the use of gas for heating purposes, in buildings and in industry”, the text reads.

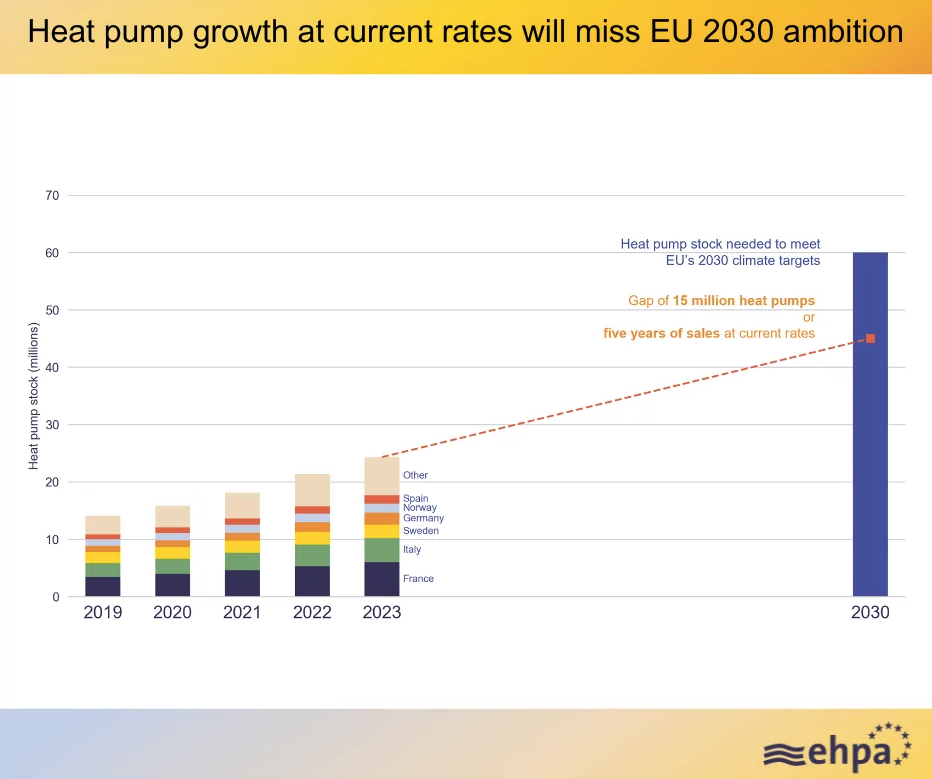

The EU target? To have at least 30 million units installed throughout the bloc by the end of this decade.

The directive has introduced facilities for the sector precisely for this purpose. The provision provides that the procedure for granting permits for installing heat pumps with a power of less than 50 MW does not last more than one month—three at most in the case of geothermal heat pumps. Connections to the transmission or distribution network are authorised within two weeks of notification to the competent authority for devices with an electric power of 12kW or less or 50kW if installed by self-consumers of renewables.

The causes behind sales contraction

However, the directive has not yet been transposed into national legislation, and the heat pump market is still experiencing ups and downs.

What are the reasons? The main reasons for the decline in European sales of heat pumps are to be sought in changing policies and support programmes. Just think of Italy, where the continuing political interventions on energy efficiency bonuses have destabilised consumer confidence. Another key reason, the association explains, is that gas prices are becoming cheaper than electricity, whose bills are also thought of by high taxes.

EU plan for heat pump, what’s the end of it?

A little bit of air should have come from the European Plan for heat pumps, but the European Commission in December 2023 announced the shutdown of the initiative. This is not a definitive cancellation, explains the EU Executive itself, but only a stand-by due to the elections. However, the work will hardly be resumed before 2025. And in the meantime, the market is trying to boat.

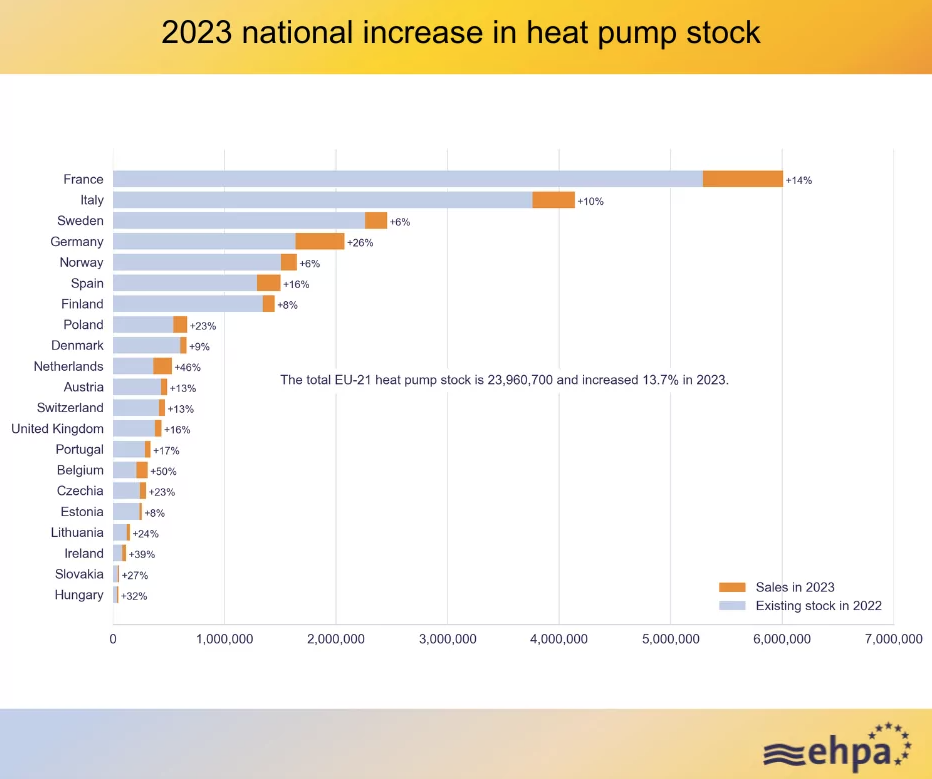

The 3.02 million heat pumps sold in 2023 bring the total installed in European buildings to 23.96 million. However, according to the EHPA, if annual sales remain at this level, about 45 million heat pumps will be installed by 2030, about 25% less than the EU’s targets.

“With more than 250 production sites in Europe, every heat pump sold and installed boosts the European clean technology industry and its competitiveness,” said Mélanie Auvray, Policy Manager at the Association. “Ensuring continued growth in the sector will help our energy independence and path towards a net zero-emission economy. The delayed Heat Pump Action Plan is crucial to stabilize the industry and take advantage of its benefits. The new European Commission must publish it quickly.“